Energy major Chevron Corporation has entered into a definitive agreement with New-York based Hess Corporation to acquire all of the outstanding shares of Hess, in an all-stock transaction valued at $53 billion (or $171 per share).

Under the terms of the agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share. The total enterprise value, including debt, of the transaction is $60 billion.

The transaction price represents a premium of 10.3% on a 20-day average based on closing stock prices on October 20, 2023.

The transaction has been unanimously approved by the boards of directors of both companies and is expected to close in the first half of 2024. The acquisition is subject to Hess shareholder approval, to regulatory approvals and other customary closing conditions.

In addition, John Hess which is the chief executive of Hess Corporation, is expected to join Chevron’s board of directors.

The acquisition of Hess upgrades and diversifies Chevron’s already advantaged portfolio. The deal also increases Chevron’s estimated five-year production and free cash flow growth rates, and is expected to extend such growth into the next decade.

In Guyana, Hess has a 30% ownership in more than 11 billion barrels of oil equivalent discovered recoverable resource with high cash margins per barrel, strong production growth outlook and potential exploration upside.

In the Bakken, Hess has 465,000 net acres of high-quality, long-duration inventory supported by the integrated assets of Hess Midstream. It has also complementary Gulf of Mexico assets and steady free cash flow from Southeast Asia natural gas business.

In January, Chevron expects to recommend an increase to its first quarter dividend per share of 8% to $1.63, which will be subject to the approval of the Chevron Board of Directors.

Post closing, Chevron intends to increase share repurchases by $2.5 billion to the top end of its guidance range of $20 billion per year in a continued upside oil price scenario.

Furthermore, the combined company’s capital expenditures budget is expected to be between $19 and $22 billion.

With a stronger portfolio after closing, Chevron expects to increase asset sales and generate $10 to $15 billion in before-tax proceeds through 2028.

The transaction is expected to achieve run-rate cost synergies around $1 billion before tax within a year of closing.

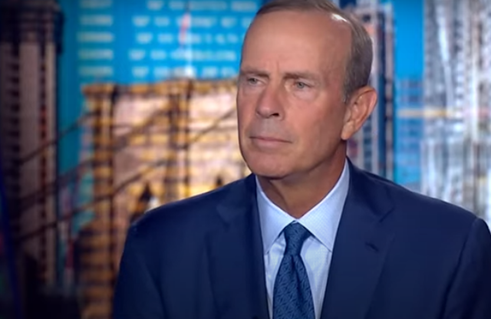

Mike Wirth, Chevron chairman and chief executive said: “This combination positions Chevron to strengthen our long-term performance and further enhance our advantaged portfolio by adding world-class assets. Importantly, our two companies have similar values and cultures, with a focus on operating safely and with integrity, attracting and developing the best people, making positive contributions to our communities and delivering higher returns and lower carbon.”

Energy company Hess Corporation is engaged in the exploration and production of crude oil, and natural gas with leading positions offshore Guyana, the Bakken shale play in North Dakota, the deepwater Gulf of Mexico and the Gulf of Thailand.