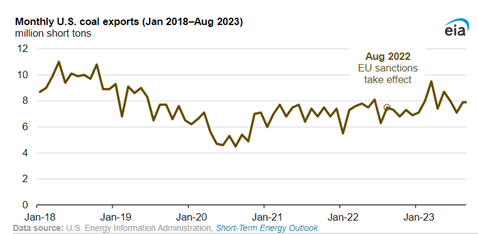

U.S. coal exports increased by 5.7 million short tons (MMst) in the 12 months after EU sanctions on coal from Russia went into full effect in August 2022.

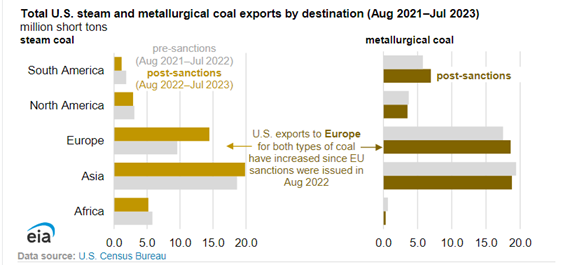

The increase was driven almost exclusively by a 22% jump in U.S. coal exports to Europe, totaling 33.1 MMst between August 2022 and July 2023 compared with 27.1 MMst during the same period prior to the sanctions (August 2021–July 2022).

In 2021, Europe received 84.6 MMst of coal from Russia, about one-third of Russia’s total exports.

After Russia’s full-scale invasion of Ukraine in February 2022, the EU responded by imposing sanctions on coal from Russia in April 2022, with a grace period for pre-existing contracts that lasted until August 2022.

Once a ban on European buyers purchasing coal from Russia went into full effect in early August 2022, imports of coal from Russia into Europe fell to almost nothing.

The United States joined other coal-supplying countries, including South Africa and Colombia, to make up the difference. U.S. coal exports also increased to Asia and South America, but declined in Africa, Australia and Oceania, and North America.

As a swing, or higher-cost, supplier in global steam coal markets, the United States was positioned to shift steam coal exports to Europe.

For the 12 months after full implementation of the EU sanctions went into effect, from August 2022 to July 2023, U.S. steam coal exports to Europe totaled 14.4 MMst, 51% more than over the previous 12-month period (August 2021–July 2022).

This increase and a 6% increase to Asia contrasted with declines in U.S. steam coal exports to the other four continents to which the United States exports steam coal. U.S. steam coal is a comparable quality to that produced by Russia, making it a natural substitute; both countries have premium-quality bituminous coal with a high heating value.

U.S. metallurgical coal exports to Europe rose only 6% (compared with the previous 12-month period) to 18.6 MMst during August 2022–July 2023.

U.S. metallurgical coal exports to South America increased, but exports to Africa, Asia, Australia and Oceania, and the rest of North America declined. Exports of metallurgical coal have been more stable because this coal is used strictly to produce iron and steel.

Source: U.S. Energy Information Administration