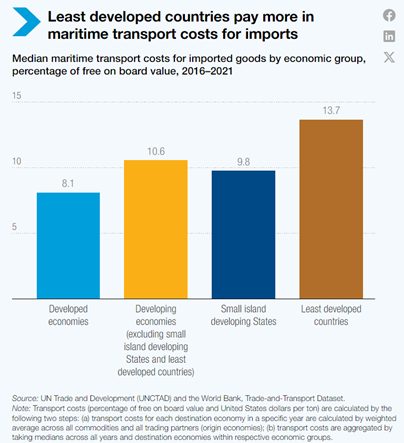

UNCTAD, the UN trade and development body, in its latest report released “Review of Maritime Transport 2024” clearly highlights that the global economy, food security, and energy supplies are at increasing risk due to vulnerabilities at key maritime routes. Furthermore, the disruptions and rising costs are affecting vulnerable economies, especially small island developing states (SIDS) and least developed countries (LDCs), which are experiencing the worst impacts.

The Review of Maritime Transport 2024 reveals that critical chokepoints such as the Panama Canal (connecting the Pacific and Atlantic Oceans), the Red Sea and the Suez Canal (linking the Mediterranean Sea to the Indian Ocean via the Arabian Peninsula), and the Black Sea (an important hub for grain exports), are under severe strain.

An analysis suggests that if the rise in container freight rates observed between October 2023 and June 2024 and caused by the disruptions in the Red Sea and Panama Canal continues until the end of 2025, global consumer prices could rise by 0.6% by the end of 2025.

For SIDS, the potential impact is even more severe, with prices increasing by 0.9%, and processed food prices possibly rising by 1.3%.

SIDS economies rely heavily on shipping for essential imports, but their maritime connectivity has declined by 9% on average over the past decade, making their isolation more pronounced.

Today, on average, SIDS are ten times less connected to global shipping networks compared to non-SIDS countries.

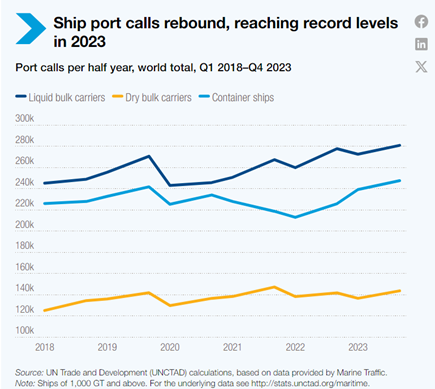

UNCTAD explained in its report that maritime trade, which grew by 2.4% in 2023 to reach 12,292 million tons, had begun to recover after a contraction in 2022. “However, the future remains uncertain,” says UNCTAD.

Although the report projects a modest 2% growth for 2024, driven by demand for bulk commodities like iron ore, coal, and grain, alongside containerized goods, the figures “mask deeper challenges.”

Container trade, which grew by just 0.3% in 2023, is expected to rebound by 3.5% in 2024, but long-term growth will depend on how the industry adapts to ongoing disruptions, such as the war in Ukraine and rising geopolitical tensions in the Middle East. Furthermore, the supply of container ship capacity grew by 8.2% in 2023.

Meanwhile, global ton-miles rose by 4.2% in 2023, driving up costs and emissions. By mid-2024, rerouting vessels away from the Red Sea and Panama Canal had increased global vessel demand by 3% and container ship demand by 12%, compared to what it would have been without these disruptions.

According to the new report released, port hubs like Singapore and major Mediterranean ports are now under pressure, as they cope with growing demand for transshipment services due to the rerouting of vessels.

On the other hand, progress remains slow as the transition to greener ships and low carbon fuels is still in its early stages. Fleet renewal has been hampered by uncertainty over future fuels and technology.

By early 2024, only 50% of new ship capacity orders were for vessels capable of using alternative fuels.

Meanwhile, scrapping older ships has slowed due to the high freight rates and increased demand for vessels following the rise in shipping distances.

Another pressing issue is the rise of fraudulent ship registrations and registries, undermining safety, security, pollution control, and seafarer welfare. This is compounded by a growing “dark fleet” of ships that operate under the radar, bypassing international regulations.

UNCTAD’s report calls for urgent action to strengthen the resilience of maritime chokepoints, infrastructure and operations, promote low-carbon shipping and combat the growing problem of fraudulent ship registrations.