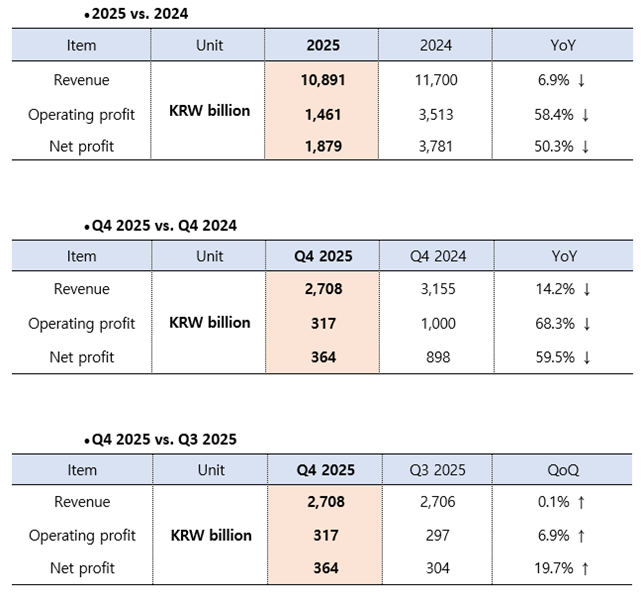

South Korean shipping giant HMM reported a net profit of KRW 1,879bln in 2025 (about $1.29bln) and an operating profit of KRW 1,461bln.

The company’s revenue in 2025 stood at KRW 10,891bln.

The operating margin in 2025 stood at 13.4%, maintaining solid profitability despite a weak global shipping market.

The Shanghai Containerized Freight Index (SCFI) averaged 1,581 points in 2025, representing a 37% decline from the 2024 average of 2,506 points.

Freight rates declined sharply across major trade lanes, including the U.S. West Coast (-49%), U.S. East Coast (-42%), and Europe (-49%).

In the third quarter, HMM recorded a 6.9% quarter-on-quarter increase in operating profit, with an operating margin of 11.7%.

Looking ahead, HMM said a large volume of new container vessel deliveries is expected to result in oversupply, while demand growth remains weak, likely to exacerbate supply-demand imbalances.

In the container segment, HMM plans to expand its hub-and-spoke-based network and strengthen low-emission service offerings to increase market share and improve cost structures through optimized feeder operations.

In the bulk segment, the company aims to achieve stable growth by diversifying its portfolio and identifying new business opportunities.