Image: Aristides Pittas, chairman-chief executive

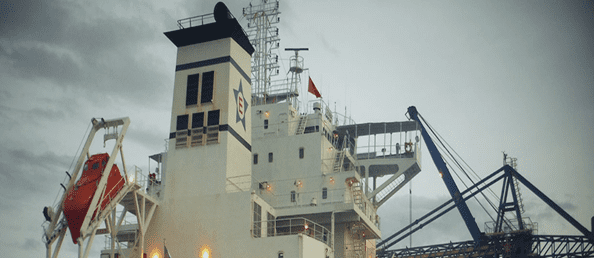

Greek drybulk owner and operator EuroDry confirmed it is teaming up with a number of investors represented by NRP Project Finance to form a joint venture regarding the ownership of two recently acquired ultramax vessels.

Specifically, NRP investors will acquire a 39% ownership stake in each of the vessels Christos K of 63,197 dwt, formelly knownas the Giants Causeway, and Maria of 63,153 dwt formelly known as the Sadlers Wells, both built in 2015.

Furthermore, the Greek firm led-by Aristides J. Pittas said that it took delivery of the Christos K and that it arranged a sustainability-linked loan of $11m with Eurobank to partly finance the acquisition.

A third vessel bought is the 63,177 dwt, 2014-built Gallileo. The three vessels were bought for a total price of about $65m.

When formally announcing a deal for three ultramax bulkers on 12 September, however, EuroDry did not make any mention of NRP, merely stating that it funded the $65m acquisition through its own funds and bank debt.

After the delivery of the remaining one vessel agreed to be acquired, the EuroDry fleet will grow to 13 bulkers.

The Nasdaq-listed owner will have two kamsarmax drybulk carriers, five panamax drybulk carriers, five ultramax drybulk carriers, and one supramax drybulk carrier.

EuroDry’s 13 drybulk carriers have a total cargo capacity of 918,502 dwt.

Aristides Pittas, chairman and chief executive of EuroDry commented: “We are very pleased to partner with the NRP team, a Norwegian investment and project finance firm, and we are excited to announce our joint venture with investors represented by NRP. This joint venture transaction helps us fund our fleet growth strategy in a non-dilutive way to our shareholders. It also allows us to broaden our investor base and establish a presence in a highly reputable and experienced shipping market.

“In parallel, we are also pleased to welcome M/V Christos K into our family, further increasing the “eco” cluster of our fleet. We look forward to continuing looking for accretive transactions and ways to finance our growth creating value for our shareholders.”