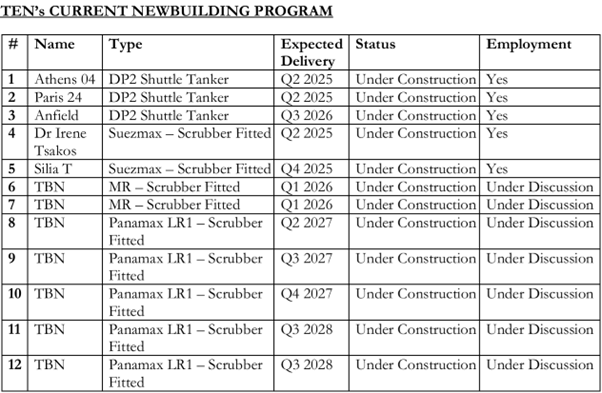

With 21 new vessels, three of which DP2 shuttle tankers under construction on long-term contracts to significant energy users, TEN’s management continues to actively explore strategic opportunities, across all sectors in which it operates.

New York-listed Tsakos Energy Navigation (TEN) also reveals that it will explore “divestment opportunities” for its earlier generation vessels and in that way monetize the full value of the assets the current market environment is providing for.

Meanwhile, 30 vessels reported with new and extended charters at significantly higher rates, whilst 21 vessels contracted/acquired within 2024.

“With a fleet of 74 vessels, 11 of which underwent scheduled dry dockings this year, thus far, the fleet performed well, setting high standards for operational excellence, fleet growth and shareholders rewards. The $1.50 per common share total dividend for 2024 is proof to that,” Mr. George Saroglou, president of TEN commented.

“With healthy cash balances and committed growth, we remain confident that TEN will be at the forefront of growth and value investors going forward,” Mr. Saroglou concluded.

Currently, TEN’s fleet consists of 74 vessels, including three DP2 shuttle tankers, two scrubber-fitted suezmax vessels, two scrubber-fitted MR product tankers and five scrubber-fitted LR1 tankers under construction, consisting of a mix of crude tankers, product tankers and LNG carries, totaling 8.9 million dwt.

In the first nine months of 2024, with 11 vessels undergoing scheduled dry docking and three performing repositioning voyages, TEN’s fleet generated gross revenues and operating income of $615.8m and $236.1m respectively, including $48.7m in gains from vessel sales.

This resulted in net income, for the first nine months of 2024, of $157m, equating to $4.62 per common share.

Adjusted Ebitda for the 2024 nine months reached $314.1m, a $100.1m increase from the 2024 six-month level.

Fleet utilization, reflecting the fleet’s increased dry dockings and repositioning activity over the first nine months of 2024, was at 92.2% making the average TCE per ship per day settling at $33,390, a healthy and accretive level, according to TEN.

As far as its third quarter results for 2024, the shipowner said that the resulting net income of $26.5m or $0.67 per common share largely reflected the higher depreciation costs assumed during the quarter due to the higher number and larger size of vessels in the fleet when compared to the third quarter of 2023.