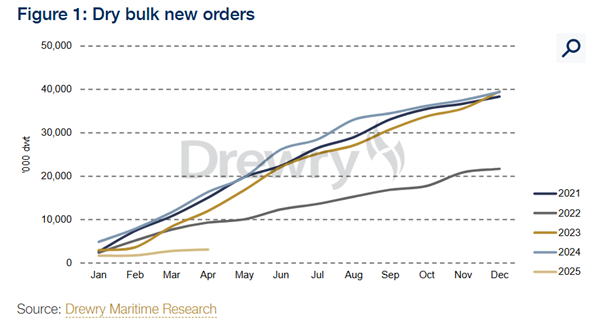

Newbuilding contracting has plummeted over the first few months of 2025, reaching historically low levels as shipowners avoid long-term investment decisions. A number of factors such as high newbuilding prices, USTR proposal, trade uncertainty and regulatory ambiguity have resulted in a sharp decline in new orders so far in 2025.

The subdued ordering activity will persist until at least October 2025, with only a gradual recovery anticipated thereafter, whilst a more substantial rebound in new orders is likely to materialise from 2028, according to a market analysis from Drewry.

The plunge in newbuilding activity comes on the heels of geopolitical disruptions and ongoing tariff wars combined with increasing concerns over China-made ships and uncertainty with respect to global regulatory environments, including the IMO’s net zero framework.

In accordance with the analysis, new orders are expected to remain muted until October 2025 with a slow recovery expected after the IMO session in October, if adopted.

In any case, the ordering activity is expected to be below historical levels until 2027 when the IMO will make clear incentives for ships employing zero or near-zero fuels and technologies.

Moreover, the threat of potential restrictions on ordering vessels at Chinese shipyards remains a key concern, leaving many shipowners on the sidelines, hesitant to commit to new investments.

The US administration’s contemplation of sanctions on China-built, -operated or -owned ships added a strategic uncertainty that few shipowners feel comfortable with.

China has long dominated global shipbuilding, including dry bulk vessels; more than 75% of these vessel new orders in 2024 were placed at Chinese yards.

The share of Chinese yards, however, has come down to 40% among all dry bulk orders placed so far in 2025, as shipowners have become increasingly cautious, according to Drewry’s market opinion.

While a final resolution on these measures has been put on hold, the threat itself has been enough to result in a dramatic retreat in order placements at Chinese yards.

Since newbuilding prices are already high, shipowners are holding on placing new orders in anticipation of softening newbuilding prices.

Meanwhile, shipowners are also worried about the uncertainty around the future environmental compliance requirements.

While clearer direction on USTR or US tariffs may support some recovery in ordering towards the end of this year, a well-defined regulatory framework will drive sustained new orders.

“However, we believe new ordering will only gather momentum after 2027 once emissions penalties are clearly defined, enabling shipowners to make informed decisions on engine and fuel choices,” Drewry’s market opinion concludes.