In the past four weeks, shipping lines have been trying to reduce Transpacific capacity, due to a drop-off in bookings as a direct consequence of the tariffs, Denmark-based research and analysis specialist Sea‑Intelligence reported.

Alan Murphy, chief executive officer of Sea-Intelligence now warns that with this latest development the lines need to ramp capacity up quickly, to accommodate for an expected surge in bookings, because getting cargo into the US before the new August 14th cut-off, requires peak season cargo to be shipped no later than by mid-July.

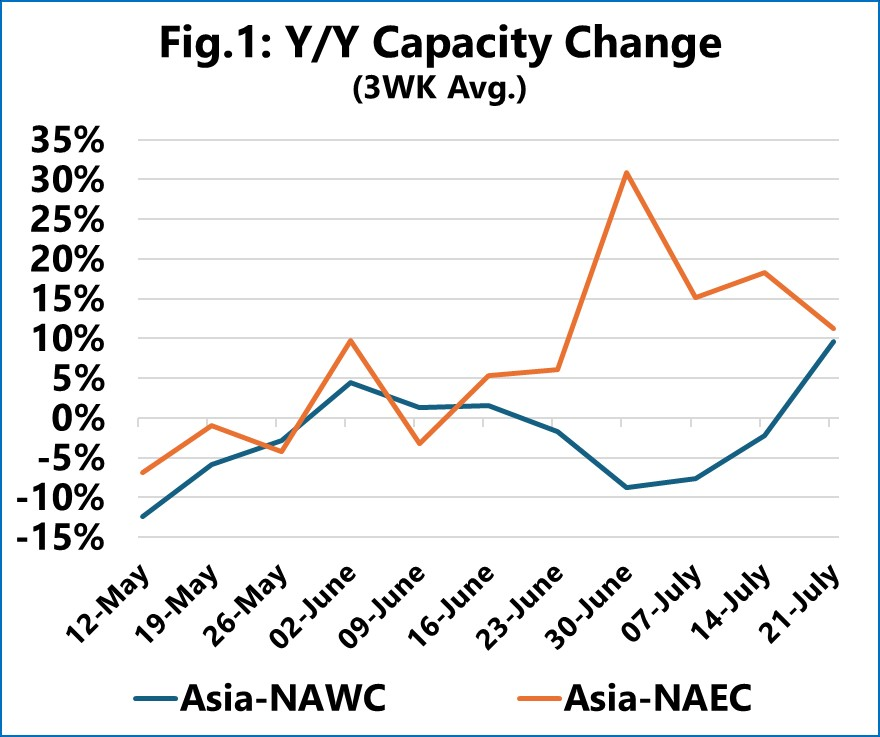

To see whether there have been any immediate changes in capacity, in Sea‑Intelligence’s issue 715 of the Sunday Spotlight, the company looked at the changes in capacity for the period of May 12-July 21, as it was on May 16 compared to as it was on May 9.

In accordance with Sea‑Intelligence report, on the Transpacific trade to the North America West Coast, there is not yet a meaningful injection of new capacity in the immediate future.

“This development, or lack thereof, to the West Coast becomes even more noteworthy in the face of the development to the East Coast, where it does appear that there is already some attempt to increase capacity, relative to a week ago,” the research and analysis specialist said on May 22.

As it is explained, figure 1 shows the Y/Y capacity change, as a rolling 3-week average, for both Transpacific trade lanes across the same May 12-July 21 period.

“Here we see a continuing Y/Y reduction in capacity in the coming few weeks to both coasts. We also see that the West Coast only sees a meaningful increase from mid-July, whereas the East Coast sees a significant capacity growth from end-June. But this is still very late for a capacity increase, if there is an imminent surge of cargo from China,” Alan Murphy noted.