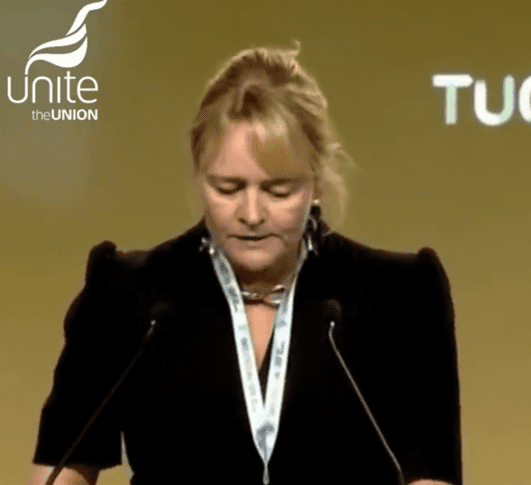

Image: Sharon Graham, General Secretary of Unite the union

UK´s Unite the union announced today that around 85 offshore workers employed by Petrofac Facilities Management Limited are set to take strike action over six days on installations operated by Ithaca Energy.

The strike action includes electrical, production and mechanical technicians in addition to deck crew, scaffolders and crane operators. The strike action will begin on 1 October and ends on 7 October.

The Unite trade union said the dispute centres on Ithaca Energy’s fourteen days ‘clawback’ policy. Petrofac offered to reduce this policy to twelve days, the union said, adding that the industry norm is seven days.

The union said its members overwhelmingly rejected the contractor’s offer.

“Twelve days would still leave the Petrofac workers operating under the highest rate of ‘clawback’ days in the offshore sector. It is the financial equivalent of up to £6,000 lost income per person,” the union notes.

Unite general secretary Sharon Graham said: “Unite’s Petrofac Ithaca members continue to stand firm in the fight for better jobs, pay and conditions. Unite’s members rightly rejected the latest offer because it would still leave them having to work the highest number of clawback days in the offshore sector. This is unacceptable. Our members will have their union’s full support in the latest phase of their strike action.”

Last week, Unite revealed that around 85 offshore workers on a number of Shell installations overwhelmingly accepted an improved wage offer. The deal secured a cumulative increase of 10%, which is worth a pay increase of up to £6,000.

A number of other improvements were secured including enhancements to sick pay and Shell’s own clawback policy on the Gannet, Nelson, Shearwater and Brent Charlie installations.

John Boland, Unite industrial officer, added: “Unite’s Petrofac members on a number of Ithaca installations will no longer tolerate a situation which leaves them the worst-off in terms of clawback days across the offshore sector.”

Unite’s Petrofac Ithaca members continue to stand firm in the fight for better #JobsPayConditions. They rightly rejected the latest offer because it would still leave them having to work the highest number of clawback days in the offshore sector. https://t.co/haR7cK8woK

— Sharon Graham (@UniteSharon) September 19, 2023