While the position of the largest global terminal operators (GTOs) at the top of the rankings look secure, the number of companies seeking to invest in the global ports market has increased in recent years. However, with global container port volumes increasing by just 0.5% in 2022, mergers and acquisitions (M&A) has emerged as the quickest route to build market share.

In 2022, there was a net increase in the number of companies that qualified as GTOs from 20 to 21. While HHLA dropped out of the rankings due to the closure of its terminal in Odessa after the Russian invasion of Ukraine, MSC and Wan Hai entered the rankings in 7th and 19th position, global shipping consultancy Drewry said in its global container terminal operators report.

“Also China Cosco Shipping gained ground on back of its increased stake in Tianjin Container Terminal, while China Merchant’s equity-throughput gains follow on from the uplift in shareholding in Shanghai International Ports Group and Ningbo Zhoushan Port Co.”

“In contrast, APMT slipped down the rankings due to the full-year impact of the sale of Rotterdam Maasvlakte in 2021 and sale of minority stake in Wilhelmshaven in 2022. Similarly, DP World’s monetisation strategy, which has reduced its equity-stake in its flagship Jebel Ali terminal to less than 68% underpinned the 3.1% drop in equity throughput in 2022,” added drewry.

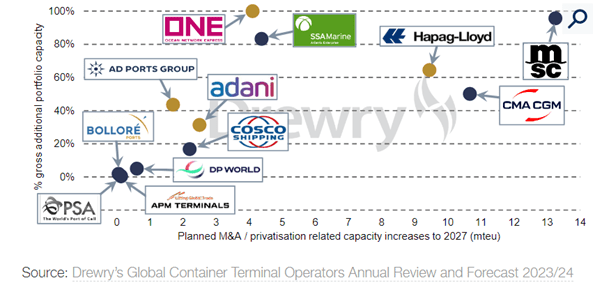

According to Drewry’s latest Global Container Terminal Operators annual review and forecast report, M&A-led growth strategies will propel leading regional terminal operators and container shipping lines into the global terminal operator rankings next year.

Eleanor Hadland, author of the report and Drewry’s senior analyst for ports and terminals said: “Increased M&A and privatisation activity will see the number of global terminal operators increase. Hapag Lloyd, ONE, Adani and Abu Dhabi Ports Group are all set to feature in next year’s league tables.”

Drewry says that in 2023 high-interest rates have already increased the opportunity cost of funds invested.

It believes that interest rates will remain elevated in the short term, which will see operators reappraise business cases for capital investments as the hurdle rates of return move upwards.

The consultant also says that small-scale projects that can be funded from cashflow, especially those which generate productivity and sustainability gains, are less likely to be delayed than greenfield projects and major terminal expansions.