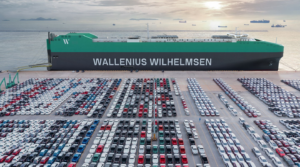

Two financial partners are joining forces to enable Korean maritime companies to tap into Singapore’s regional network and suite of financing solutions.

Singapore-headquartered financial services group DBS and the Korea Ocean Business Corporation (KOBC) have signed a memorandum of understanding (MOU) to strengthen business connectivity and support the regional expansion of Korea’s maritime and logistics sector across Asia.

KOBC is a financial institution under the Republic of Korea’s ministry of oceans and fisheries. This collaboration marks KOBC’s first partnership with a foreign bank, enabling Korean maritime companies to leverage DBS’ extensive regional network and financing solutions, including digital cross-border payment capabilities, trade financing and sustainable financing solutions.

The agreement was announced alongside the opening of KOBC’s first overseas branch in Singapore.

The release by DBS notes that Korea is one of the world’s top three shipbuilding nations and a global leader in high-value vessels, with its shipping and logistics firm operating across major global routes.

With Singapore consistently ranked the world’s top maritime centre, DBS is well placed to support Korean firms as they extend their global footprint.

Under the agreement, DBS and KOBC will collaborate to facilitate KOBC’s access to Singapore’s financial market, including trade financing, treasury support and capital-raising opportunities; develop sustainable finance solutions such as transition financing for eco-friendly vessels and alternative maritime fuels; and enhance competitiveness across the maritime and logistics value chain, supporting Korean players as they expand into the rest of Asia.

“Korea’s maritime sector is a critical pillar in global trade, and its leading players are increasingly looking outward for growth and greener operations. With Singapore as a global maritime hub and DBS’ extensive network across Asia, we are well positioned to connect Korean firms to new markets and help them capture emerging opportunities,” says Han Kwee Juan, DBS’s group head of institutional banking.