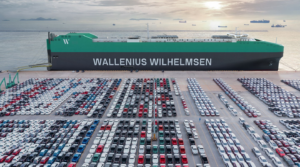

Hayfin has revealed that Tokyo-headquartered bank Sumitomo Mitsui Trust Bank, Limited (SuMi TRUST Bank) invested in Hayfin’s Maritime Yield strategy, bringing total strategy commitments to over $620m across the commingled fund and related separately managed accounts.

To remind, Hayfin Capital Management is an alternative asset management firm.

The company said the investment is the latest addition to the c.$400m in capital commitments raised for the fund in 2023 and has taken Hayfin’s total deployment capacity significantly past $1bn when coupled with conservative debt financing.

“This latest fundraising round is a further extension of Hayfin’s track record in the maritime sector, having invested in excess of $4 billion across various sectors – dry bulk, tankers, containers, LPG, and LNG,” says Hayfin in its statement.

The firm said it has deployed capital into the sector through its private credit strategies, as well as the Maritime Yield strategy, which focuses on building a diversified asset-owning platform, generating long-term, stable income.

SuMi TRUST Bank’s commitment will directly support the development of sustainable maritime transportation through the Hayfin Maritime Yield strategy, according to Hayfin.

Andreas Povlsen, head of maritime, said: “We’re delighted to have secured this important commitment from SuMi TRUST Bank, underlining our lasting commitment to the Japanese market through our Maritime Yield strategy – not just investors, but also shipbuilders, operators, leasing companies and trading houses.”