The CII (Carbon Intensity Indicator) is becoming increasingly influential in the sale and purchase market. Brokers and shipowners are starting to observe the impact of energy efficiency regulation on the S&P market, particularly regarding the risks now associated with vessels which are operating in band E. Currently, the effects are most prominent in the Tanker market, with band E vessels trading infrequently with substantial discounts, followed by the Bulker market.

“CII is becoming increasingly influential in the sale and purchase market. At the moment, this is primarily manifesting in the liquidity of vessels. Those vessels operating in band E have substantially lower liquidity than vessels operating in other bands,” according to an analysis of online valuation and market intelligence provider, VesselsValue.

The data provider also observes the effects of changes in the earnings potential of a vessel on the value of that vessel.

The CII measures how efficiently a vessel above 5,000 GT transports goods or passengers and is given in grams of CO2 emitted per cargo-carrying capacity and nautical mile.

The first reporting of the CII based on 2023 data is due no later than 31 March 2024. Vessels will receive a rating of A (major superior), B (minor superior), C (moderate), D (minor inferior) or E (inferior performance level). The rating thresholds will become increasingly stringent towards 2030. A vessel rated D for three consecutive years or rated as E, will need to develop a plan of corrective actions.

According to analysis by VesselsValue, for band A vessels to operate in band C, the required 9% increase in speed would result in a 7% increase in vessel value. While for band E vessels to operate in band C, the average speed reduction of 12% would result in a discount of 12%.

The effects are most prominent in the tanker market, with band A vessels potentially able to generate an average value premium of 9%, and band E vessels suffering an average discount of 15%, as VesselsValue notes.

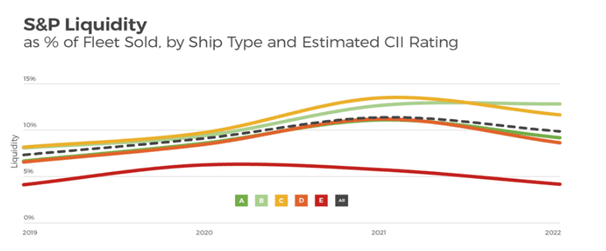

Although the lowest levels of liquidity was for vessels having a rating of E, that gap has widened substantially, as it is highlighted.

Liquidity of band E vessels decreased during 2021, when liquidity of vessels operating in other bands increased substantially.

Furthermore the data provider also observed a rise in demand for cheaper, older tankers that have entered into the so called ‘dark fleet’ to trade sanctioned cargoes over the past few months, potentially creating a two tier market. “It remains to be seen if this is sufficient to weaken the observed trends,” as it is said.

The IMO’s Carbon Intensity Indicator (CII), which became effective on 1 January this year, has been a subject of criticism about its complexities and many shipowners and CEOs have stressed the need of an urgent revision due to the “unfairness, and the weaknesses of the measure.”

Ian Beveridge, CEO of the Schulte Group, addresses the challenges and measures that lie ahead for shipping, in a very interesting article, and adds his voice to the criticism about the Carbon Intensity Indicator saying that the “required interaction and cooperation between the parties needs to be contractually regulated, and here the industry has hit a roadblock.”

Schulte Group´s CEO considers that the penalties for non-compliance are unclear, leading to many charterers and owners adopting a ‘wait and see’ attitude. Despite this, Bernhard Schulte Shipmanagement (BSM) since early last year has started preparing for CII by setting up a Fleet Performance Centre with 25 expert staff, enhancing vessel efficiency monitoring tools with a proprietary software, installing sensors on a large number of vessels for near real-time monitoring, and providing training to its officers.