John Fredriksen’s tanker giant Frontline is strategically renewing its fleet with the sale of eight older VLCCs and the purchase of nine latest-generation new ones.

The shipowner has agreed to sell eight of its oldest first-generation very large crude carriers (VLCCs), built between 2015 and 2016 for a total sales price of $831.5m.

The vessels are set for delivery to the new owner during the first quarter of 2026.

Frontline said it expects the transaction to generate net cash proceeds of around $486m and to record a gain in the first quarter of 2026 in the range of approximately $217.4m to $226.7m, depending on the delivery date of each vessel.

The sale, it said, remains subject to certain closing conditions in line with industry standards.

In parallel, the tanker owner has confirmed a deal to acquire nine latest-generation scrubber-fitted VLCC newbuildings from an affiliate of Hemen Holding Limited, the company’s largest shareholder, for an aggregate purchase price of $1,224.0m.

Of these nine vessels, six are currently under construction at the Hengli shipyard and three at the Dalian shipyard in China.

The delivery schedule for the vessels is attractive, Frontline said, with seven vessels due for contract delivery during 2026, commencing in the third quarter, one vessel expected in the first quarter of 2027 and the final vessel anticipated in the second quarter of 2027.

According to Frontline, the payment schedule for these acquisitions is weighted towards delivery, with the largest portion of the instalments due upon delivery of each vessel. As it is reported, the company intends to finance this acquisition with cash and long-term debt financing.

The acquisition remains subject to certain closing conditions, in line with industry standards.

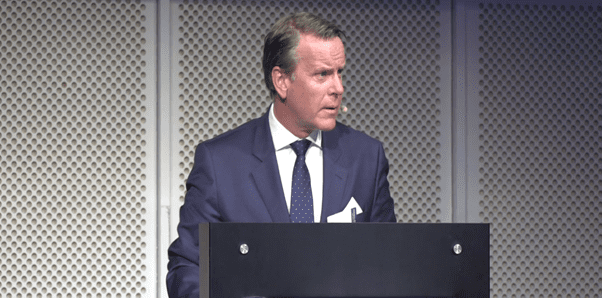

Lars H. Barstad, chief executive officer of Frontline Management AS, commented on these transactions: “These two transactions enable Frontline to renew its fleet by replacing 10-year-old first-generation ECO vessels with latest-generation, scrubber-fitted ECO vessels at very firm pricing. This aligns with our strategy of operating one of the most modern, cost- and fuel-efficient fleets in the market.

“The acquisition also supports our objective of increasing exposure to the VLCC segment without adding to overall vessel supply.

“The delivery schedule is particularly attractive, falling within a period that is generally considered closed to newbuild orders. Through this transaction, Frontline is making tangible progress toward improved fuel efficiency and reduced carbon emissions.”

Upon completion of these transactions, Frontline’s fleet will comprise of 81 vessels, including 42 VLCCs, 21 suezmax tankers and 18 LR2/aframax tankers.