Frontline sells its five oldest VLCCs, built in 2009 and 2010, for an aggregate net sale price of $290m.

The tanker shipowner did not disclose the name of the buyer but only gave details about the delivery of the ships to its new owner, saying that the delivery will take place during the first quarter of 2024.

The deal is expected to generate net cash proceeds of around $207m after repayment of existing debt on the vessels.

Furthermore, the shipowner expects to record a gain in the first quarter of 2024 in the range of around $68m to $76m, depending on the date of delivery of each vessel to the new owner.

The sale is subject to certain closing conditions, in line with industry standards.

Frontline said that is monetising older assets at a firm price while reducing the age of its fleet.

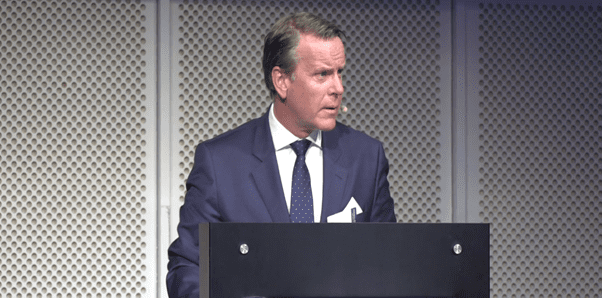

Lars H. Barstad, chief executive of Frontline Management AS, said: “We are very pleased with this transaction, capturing firm pricing for 14-15 year old vessels. Frontline has increased its position significantly in the VLCC segment during 2023 and this divestment of our remaining non-eco VLCCs is in line with our strategy of running the most modern, fuel-efficient fleet in the market.”

The tanker’s owner fleet, after this deal is completed and the delivery of all 24 VLCCs acquired from Euronav, will consist of 84 vessels comprised of 41 VLCCs, 25 suezmax tankers and 18 LR2/aframax tankers.

The aggregate capacity will be about 18.2 million dwt and an average age of only 5.9 years.