Norway-based owner Ocean Yield has struck a deal to buy a quartet of LR1 product tanker newbuildings backed by 15-year bareboat charters with rates linked to vessel’s actual carbon emissions.

“To the company’s knowledge, this is the first sustainability-linked transaction in the maritime leasing market,” said the company in a stock exchange notice.

Norway´s Ocean Yield announced on Tuesday that it has agreed to purchase four LR1 product tankers, to be constructed at Guangzhou Shipyard International (GSI) in China.

The ships will be built with a design enabling them to be converted to dual-fuel operation with methanol as fuel, whilst the delivery is expected between 2026 and 2027.

After the delivery the vessels will commence 15-year bareboat charters to guaranteed subsidiaries of Braskem S.A, which has credit ratings of BBB- from S&P and Fitch, and Ba1 from Moody’s, in accordance with Ocean Yield statement.

The bareboat charter rate will have a variable element linked to the respective vessel’s actual carbon emissions, incentivizing the charterer to keep emissions low.

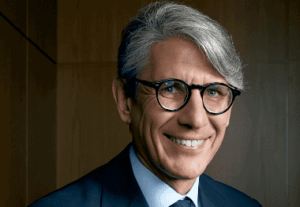

Andreas Røde CEO of Ocean Yield said in a comment: “Since Ocean Yield was established in 2012, sustainability and responsibility have been integrated parts of our core strategy as we seek to be a facilitator for the decarbonization of the shipping industry. In Braskem, we have a found a partner who shares our values and ambitions. We are excited to build on our relationship with Braskem and introduce the inaugural sustainability-linked lease to the Ocean Yield portfolio”.

The deal is expected to add approximately $300 million to Ocean Yield´s Ebitda backlog.