Greece’s Euroseas boxship owner, listed on Nasdaq stock market, led by Aristides Pittas said on Friday that it will spin-off the company’s older three vessels into a separate company, Euroholdings Ltd., which has applied for listing on the Nasdaq capital market.

The planned move concerns the 1,439-teu Aegean Express (1997-built), the 2,008-teu Diamantis P (1998-built) and the 1,732-teu Joanna (1999-built).

The owner will contribute the three vessels to Euroholdings in exchange for 100% of the shares of Euroholdings which it will then distribute to its shareholders.

However, Euroseas clarifies that there can be no assurance that the spin-off transaction will ultimately occur and if it does occur what its structure, terms or timing will be.

“We firmly believe that under the right circumstances, there is considerable value in the current environment in continuing to trade older well-maintained vessels, rather than selling them, as these can ultimately generate higher returns,” said Aristides Pittas, chairman and CEO of Euroseas.

“The increased market and operational risks associated with older vessels are mitigated by the fact that the three first Euroholdings vessels are currently unlevered, two of the three are under time charter employment providing medium term visibility of earnings and all vessels will continue to be managed by our affiliate, Eurobulk Ltd., which has a proven track record of handling older vessels,” he added.

Pittas also said in a statement that “Euroholdings with its clean balance sheet and relatively liquid platform can be used as a consolidating vehicle in the shipping sector, especially for vintage vessels, creating additional value to shareholders over the longer term.”

Meanwhile, Euroseas has sealed a new time charter deal for its older and smaller feeder boxship, Aegean Express.

The shipowner said the charter of Aegean Express has been extended in direct continuation of its existing charter for a minimum period of ten months and a maximum period of twelve months at a rate of $16,700 per day.

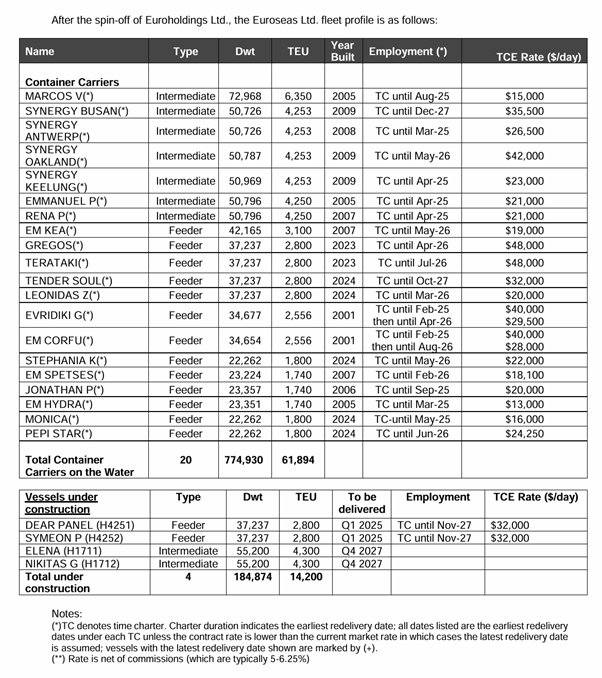

Euroseas’ Pittas also emphasized the fact that his company intends to continue with the strategy of modernizing its fleet by placing orders for 11 newbuilding vessels, seven of which have been delivered in 2023 and 2024, two are slated for delivery in early January 2025 and the remaining two in 2027.

Aristides Pittas also added that the spin-off is not expected to have any material impact on Euroseas and its overall strategy.

“The spin-off of our three older vessels into a separate entity and the distribution of all shares to our common shareholders, the only shareholder class in our capital structure, enables us to maximize the value of the older vessels in our fleet and shareholder returns by creating a new platform to capture new opportunities following a different strategy from Euroseas,” the shipowner noted.

The company has a fleet of 23 vessels, including 16 Feeder containerships and 7 Intermediate containerships.

Euroseas 23 containerships have a cargo capacity of 67,073 teu. After the delivery of two feeder and the two intermediate containership newbuildings in 2025 and 2027, respectively, Euroseas’ fleet will consist of 27 vessels with a total carrying capacity of 86,873 teu.